[ad_1]

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

The gold price has surged to new record highs this morning, amid anxiety over the Covid-19 pandemic, geopolitical jitters, and predictions that money-printing policies will drive inflation up.

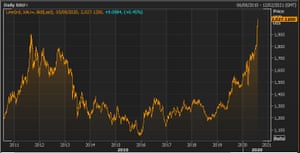

Gold smashed through $2,000 per ounce for the first time ever last night, and is now changing hands at $2,030/oz this morning – comfortably over its previous record set in 2011.

At the start of 2020, gold was worth just $1,500 per ounce, but has been rocketing steadily higher in the last few months.

The gold price over the last decade Photograph: Refinitiv

As a traditional safe haven, gold is benefiting from rising tensions between the US and China – with Beijing furious that Donald Trump is forcing TikTok to sell its US operations.

Anxiety over a second wave of Covid-19 cases in the coming months is also pushing some investors towards precious metals.

Stephen Innes of AxiCorp explains:

Concerns remain around a second wave in Europe as daily case growth has started to accelerate from shallow levels in most countries. However, the levels are nowhere near that seen in the US, which is now on a downward trajectory.

Still, markets fear a second Covid-19 surge into winter (northern hemisphere), and the associated rise in volatility still favors gold as a defensive strategy.

The recent weakness in the US dollar is also pushing commodity prices higher. Traders are also anticipating that inflation will pick up as central banks and governments launch unprecedented stimulus packages to protect their economies.

US politicians are still struggling to agree the next Covid-19 package, though, which is causing some nervousness in the markets.

White House officials have been meeting with Congressional leaders for days, but are still split over the size of the deal – and how much support should be provided to unemployed Americans.

Treasury secretary Steven Mnuchin told reporters last night that negotiators have agreed to work “around the clock” to “try and reach an overall agreement” by the end of the week, so a bill could be drawn up and (ideally) approved by Capitol Hill next week.

Also coming up today

The latest healthcheck on UK and eurozone purchasing managers is expected to show that service sector companies returned to growth last month as lockdown measures eased.

July’s UK car sales figures are also due this morning, and expected to show they rose by 11% – the first jump this year.

The agenda

- 9am BST: Eurozone service sector PMI for July; expected to rise to 55.1 from 48.3

- 9am BST: UK car sales figures for July; expected to rise by 11%

- 9.30am BST: UK service sector PMI for July; expected to rise to 56.6 from 47.1

- 1.15pm BST: ADP survey of US payrolls in July

- 3pm BST: US service sector PMI for July; expected to dip to 55 from 57.1

- 3.30pm BST: US weekly oil inventory figures

[ad_2]

Source link